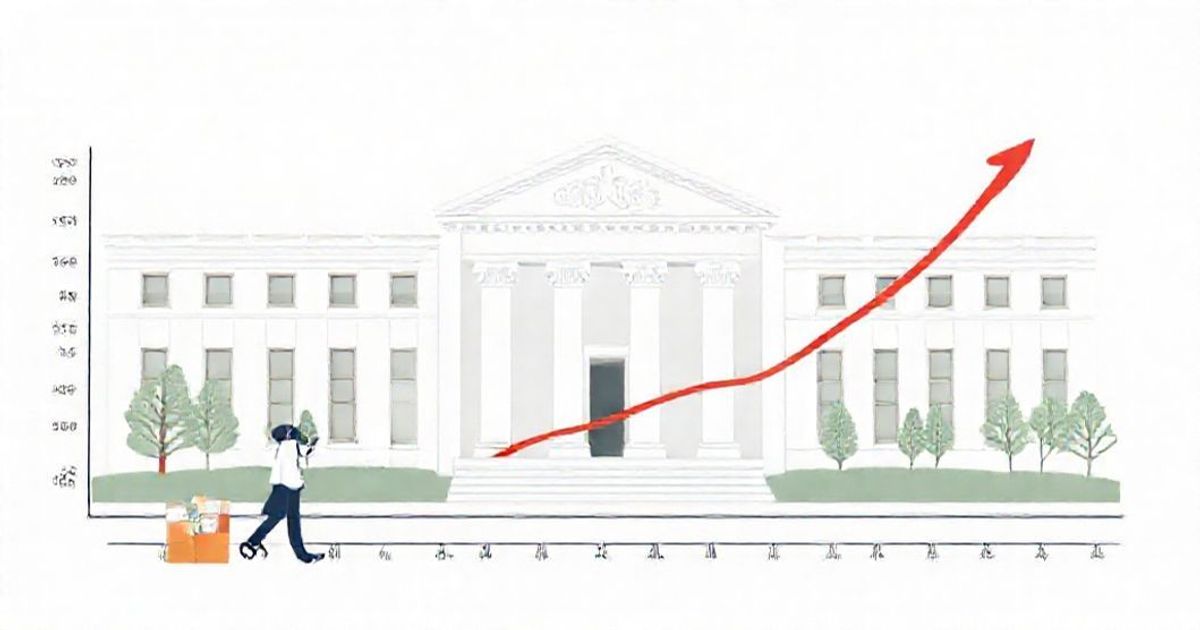

U.S. Economy Surges Past Forecasts with 4.9% GDP Growth in Q3

Strong Consumer Spending Fuels Unexpected Economic Expansion

The U.S. economy demonstrated remarkable resilience in the third quarter, expanding at a much faster pace than economists had projected. According to the Commerce Department's advance estimate, Gross Domestic Product (GDP) grew at an annualized rate of 4.9% from July through September, significantly exceeding consensus forecasts that hovered around 4.3%.

Key Drivers of Growth

The robust expansion was primarily fueled by:

- Consumer Spending: Americans continued to spend vigorously on both goods and services, defying concerns about inflation and higher interest rates

- Inventory Investment: Businesses rebuilt stockpiles after previous drawdowns

- Government Expenditure: Increased federal, state, and local government spending contributed to the growth momentum

This acceleration follows a 2.1% growth rate in the second quarter and represents the strongest quarterly performance since late 2021.

Market Implications and Federal Reserve Outlook

The surprisingly strong GDP data presents a complex picture for policymakers at the Federal Reserve. While the economy's vigor suggests underlying strength, it may also complicate the central bank's efforts to combat inflation. Market analysts are now closely watching whether this growth momentum can be sustained amid higher borrowing costs and global economic uncertainties.