Tech Titans vs. Broad Market: Analyzing the QQQ vs. SPY Investment Dilemma

The Core Investment Choice: Growth vs. Diversification

For investors navigating today's market, a fundamental decision often centers on choosing between the aggressive growth potential of technology-focused funds and the steady, diversified exposure of the broader market. This debate is perfectly encapsulated by comparing two ETF giants: the Invesco QQQ Trust (QQQ) and the SPDR S&P 500 ETF Trust (SPY).

Understanding the Contenders

The Invesco QQQ Trust (QQQ) tracks the Nasdaq-100 Index, a collection of the 100 largest non-financial companies listed on the Nasdaq. This makes it heavily concentrated in technology and innovation-driven sectors like information technology, consumer discretionary, and communication services. Top holdings typically include mega-cap leaders such as Apple, Microsoft, Amazon, and Nvidia.

Conversely, the SPDR S&P 500 ETF Trust (SPY) is designed to mirror the performance of the S&P 500 Index. This benchmark represents 500 of the largest U.S. companies across all sectors, including technology, healthcare, financials, industrials, and consumer staples. It offers a comprehensive snapshot of the U.S. economy.

Key Factors for Investors to Consider

- Risk and Volatility: QQQ's tech-heavy composition generally leads to higher volatility. It can outperform dramatically in bull markets fueled by tech innovation but may suffer deeper drawdowns during sector-specific downturns or rising interest rate environments. SPY provides greater stability through its sector diversification.

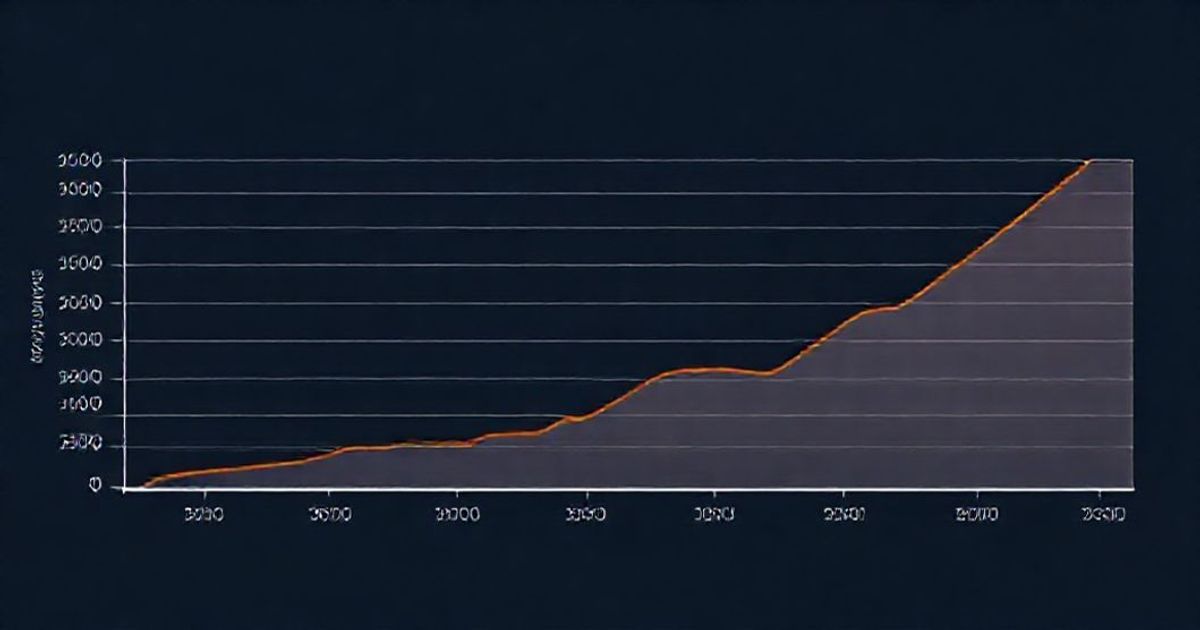

- Growth Potential: Historically, QQQ has delivered superior long-term returns, capitalizing on the transformative growth of the tech sector. Investors bullish on continued technological disruption may favor this path.

- Economic Sensitivity: SPY's performance is more closely tied to the overall health of the U.S. economy. It offers a balanced approach, providing exposure to cyclical and defensive sectors alike.

- Portfolio Role: Financial advisors often suggest SPY as a core portfolio holding for broad market exposure. QQQ is frequently used as a strategic satellite holding to amplify growth potential.

The Verdict: It Depends on Your Profile

There is no universal winner. The choice between QQQ and SPY hinges on an investor's individual risk tolerance, time horizon, and conviction in the technology sector's future outperformance. A younger investor with a long-term horizon and higher risk appetite might allocate more to QQQ. Investors seeking stability, income (via dividends from various sectors), and reduced volatility may prefer the diversified foundation of SPY. Many opt for a blended approach, using both ETFs to balance growth and stability within a single portfolio.