Merry Christmas: 30-Year Mortgage Rates Dip Lower in 2024

Key Takeaways

A pre-holiday surprise has arrived for the housing market: 30-year fixed mortgage rates have dipped lower, offering a potential year-end gift to prospective homebuyers and refinancers. This movement, while seemingly modest, arrives at a critical juncture and reflects complex underlying forces in the bond market. For traders and market observers, this dip is less about holiday cheer and more about deciphering signals regarding inflation, Federal Reserve policy, and economic resilience heading into the new year.

The Rate Dip: Unwrapping the Data

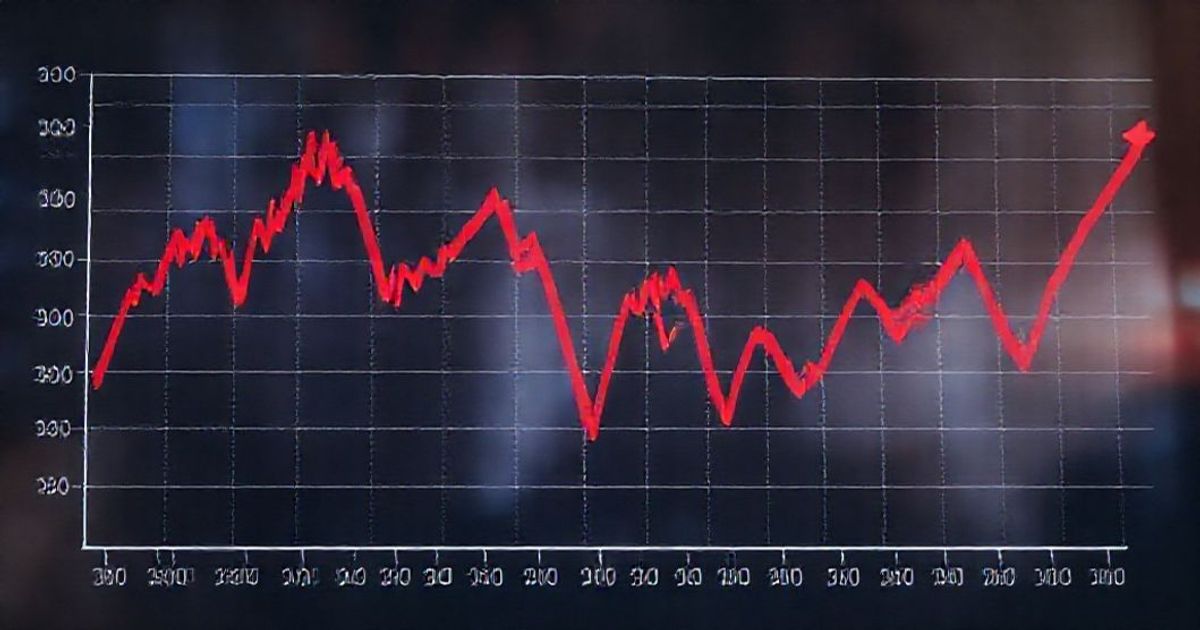

The average rate on the benchmark 30-year fixed mortgage has retreated from recent multi-decade highs, settling into a lower range as the year concludes. This decline is directly tied to movements in the 10-year U.S. Treasury yield, the primary benchmark for long-term mortgage pricing. As bond yields have softened, so too have borrowing costs for home loans. This trend often accelerates during periods of lower trading volume, like the holiday season, as markets digest economic data and position for the year ahead. It's crucial to view this dip not in isolation but within the broader context of 2024's volatile rate environment, which saw a dramatic climb followed by a tentative, uneven retreat.

What's Driving the Downward Pressure?

Several interconnected factors are contributing to this favorable shift in mortgage rates:

- Cooling Inflation Data: Recent Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) reports have shown continued, albeit bumpy, progress toward the Federal Reserve's 2% target. This data reinforces the market's belief that the central bank's tightening cycle has concluded.

- Anticipated Fed Pivot: The market is now firmly pricing in expectations for Federal Reserve rate cuts in 2024, not hikes. This forward-looking sentiment pulls longer-term yields lower, as traders position for a less restrictive monetary policy environment.

- Seasonal Liquidity and Positioning: Year-end portfolio rebalancing by large institutional investors can lead to increased demand for Treasuries, pushing prices up and yields down. Thinner holiday trading volumes can also amplify price movements.

- Economic Growth Concerns: While a hard landing is not the consensus, signs of moderating economic growth lead investors to seek the safety of government bonds, a dynamic known as a "flight to quality," which also pressures yields lower.

What This Means for Traders

For financial market participants, the movement in mortgage rates is a vital real-world indicator with significant cross-asset implications. It's not just a housing story.

Actionable Insights Across Asset Classes

- Fixed Income & Rate Sensitives: Monitor the spread between the 10-year Treasury yield and 30-year mortgage rates. A narrowing spread can signal improving bank lending sentiment or technical factors in the Mortgage-Backed Securities (MBS) market. Traders can look to ETFs like iShares MBS ETF (MBB) or Vanguard Mortgage-Backed Securities ETF (VMBS) for exposure. Be wary of volatility around key inflation prints and Fed meetings, which can swiftly reverse rate trends.

- Housing and Related Equities: A sustained dip in mortgage rates can be a catalyst for homebuilder stocks (ITB, XHB ETFs), mortgage insurers, and home improvement retailers. However, assess affordability holistically—high home prices can offset the benefit of slightly lower rates. Look for companies with strong balance sheets and pricing power.

- Macro Positioning: Falling mortgage rates corroborate a "soft landing" or "dovish pivot" narrative. This environment is generally favorable for growth stocks, particularly technology, which benefits from lower discount rates on future earnings. However, it may weigh on financial sector profitability, particularly for regional banks with large mortgage holdings.

- Currency Markets (USD): The expectation of Fed cuts that drives rates lower is typically a bearish signal for the U.S. Dollar in the medium term. Forex traders should watch for confirmation in the DXY index and adjust pairs like EUR/USD and GBP/USD accordingly.

Risks and Considerations

Traders must avoid the pitfall of extrapolating a seasonal dip into a long-term trend. Key risks include:

- Sticky Inflation: A resurgence in inflation data would force a rapid repricing of Fed expectations, sending yields and mortgage rates soaring again.

- Geopolitical Shocks: Unforeseen global events can trigger a flight to safety, but can also disrupt supply chains and reignite inflationary pressures.

- Technical Reversals: The momentum behind the rate decline may fade post-holidays as normal trading volume returns and profit-taking occurs.

Conclusion: A Cautious Gift Heading into 2024

The lower mortgage rates offering a 'Merry Christmas' to the housing market are a symptom of larger macroeconomic shifts. For traders, they represent a critical data point in the ongoing narrative of inflation's retreat and the Fed's impending policy transition. While this provides a tangible benefit to consumers and a potential boost to housing-adjacent sectors, the sustainability of this trend is not guaranteed. The path of rates in 2024 will be dictated by the hard data on prices, employment, and growth. Successful navigation will require vigilance, focusing not on the holiday sentiment but on the underlying economic fundamentals that will be unveiled in the new year. The dip is a welcome development, but the market's New Year's resolution will be tested by the first major inflation reports of 2024.