Bitcoin Faces Critical Resistance: $126,000 Trendline Caps Recovery Rally

Bitcoin's Bullish Momentum Meets Formidable Wall

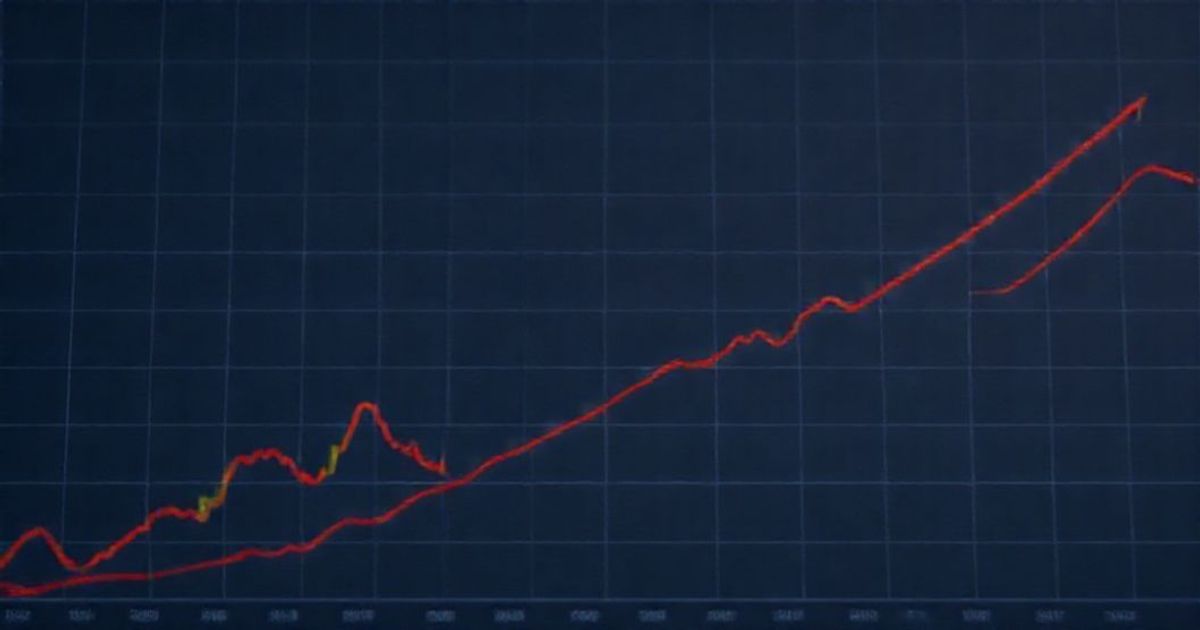

Bitcoin's attempt to stage a significant recovery was decisively halted on Monday, as a major descending trendline originating from its all-time highs near $126,000 continues to act as a formidable barrier for the world's leading cryptocurrency.

The trendline, drawn from the historic peak, represents a critical technical resistance level that has repeatedly suppressed bullish advances. Monday's price action saw BTC approach this key level once more, only to be rejected, underscoring the persistent selling pressure from long-term holders looking to exit near break-even points.

Technical Analysis Points to Consolidation Phase

Market analysts are closely monitoring this dynamic, noting that until Bitcoin can achieve a sustained breakout above this multi-month trendline, its path to reclaiming previous highs remains obstructed. The repeated rejections suggest the market is entering a phase of consolidation, where bulls and bears are battling for control.

- The $126,000 reference point establishes a long-term psychological and technical ceiling.

- Each failed test of the trendline potentially weakens bullish conviction and invites further downside pressure.

- A successful breakout with high volume could signal the start of a new macro uptrend.

The ongoing struggle at this key juncture highlights the fragile sentiment in the crypto market, where macroeconomic headwinds and regulatory uncertainties continue to weigh on investor appetite for risk assets like Bitcoin.