A Decade of Dominance: How a $500 Netflix Investment in 2014 Would Have Transformed Your Portfolio

The Streaming Giant's Meteoric Rise

A hypothetical $500 investment in Netflix (NFLX) ten years ago would have been a masterclass in identifying disruptive growth. In early 2014, Netflix was solidifying its transition from a DVD-by-mail service to the undisputed leader in streaming video, though it still faced significant skepticism from traditional media analysts.

By the Numbers: A Staggering Return

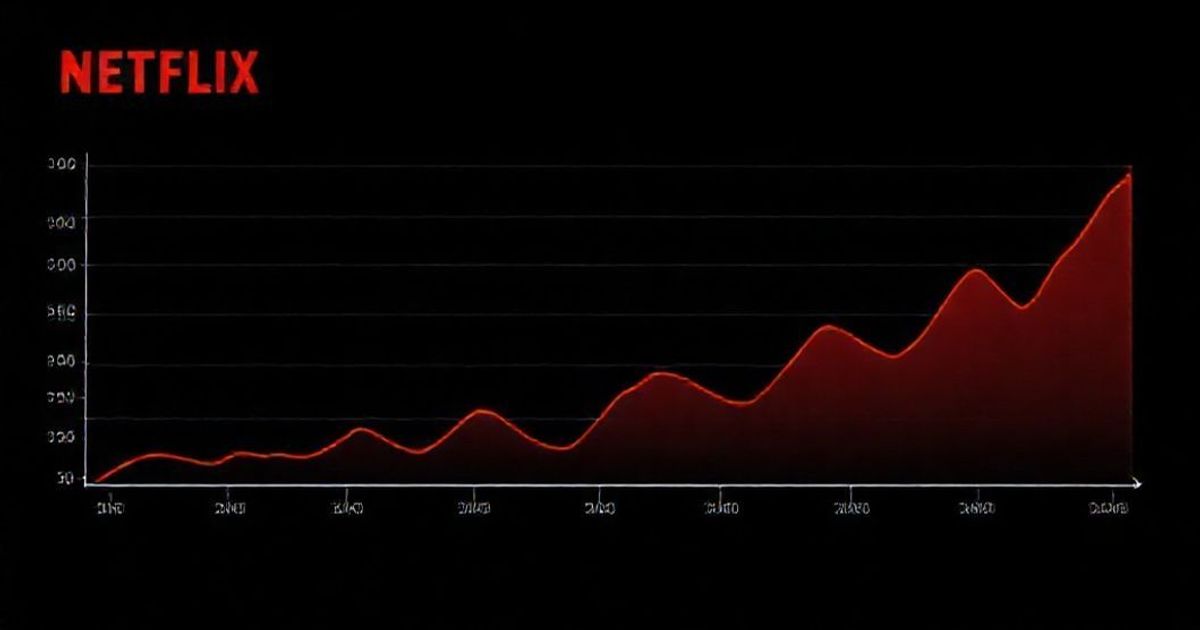

Based on historical stock price and split-adjusted data, that initial $500 investment would be worth approximately $7,850 today. This represents a monumental return of over 1,470%, dramatically outperforming the broader S&P 500 index over the same period.

The journey was fueled by several key factors:

- Global Subscriber Growth: Aggressive international expansion turned Netflix into a worldwide household name.

- Content Revolution: The bold pivot to original programming with hits like "House of Cards" and "Stranger Things" created a must-have service.

- First-Mover Advantage: Netflix's deep investment in technology and user experience built a moat that competitors are still struggling to cross.

The Lesson for Investors

While past performance never guarantees future results, Netflix's decade serves as a powerful case study in the value of investing in companies that are fundamentally changing consumer behavior. It highlights the potential rewards of backing innovative business models with large, scalable market opportunities, even amidst periods of volatility and doubt.